|

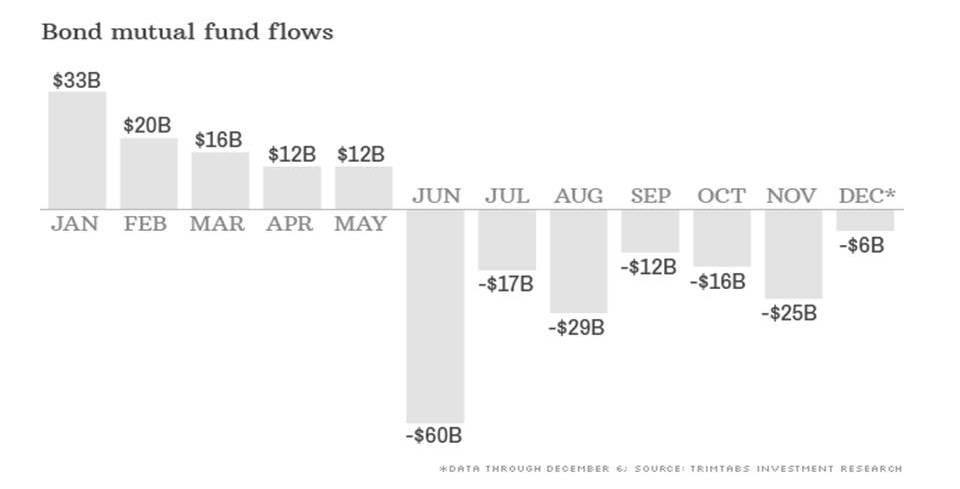

It looks like larger investors are positioning for the upcoming reduction of federal support of buying open market securities. A trader, specifically one that trades VIX futures/options (VIX is a tradable volatility security, VIX increases in up OR down markets depending on “noise” around the general movement), has recently purchased over 4 million dollars of the future right to buy VIX at its December 12th price. This points, clearly, towards increased volatility. With the equity markets at all-time highs, the economy has been expanding for 53 months, and payrolls have risen by nearly 7.5 million since February 2010. Volatility in the equity markets can only mean that there will be much larger moves on a trend going down, increased volatility is not welcome. However, these are option contracts, the trader (under his client or clients consent) can let the contracts expire with only the capital used to purchase the options lost. Conversely, the economic data points towards an ongoing economic growth period. Payrolls, hiring, confidence/optimism, and incomes are rising. Perhaps volatility could be ushered in by an anticipated fall in foot traffic of brick &mortar stores. The fall might be able to be predicted by the price movement of gasoline prices. The recent rise in gasoline prices may be a contributing factor to the rise in popularity of online retailers and slower holiday season shopping, on the ground. Look for holiday shopping figures, or Q4 figures, reported strictly by brick and mortar outlets, to be not as robust as anticipated. Despite my anticipated slower PHYSICAL goods consumption, I believe that given positive data flow we may see stronger reported sales by online retailers. “I will make one prediction: The early forecast about holiday shopping will be wrong; the season will be better than worst expectations, perhaps not living up to the most optimistic ones.” Link Another contributing factor for a potential slowdown in Q4 GDP figures can be attributed to the government shutdown. Federal workers were not paid which means a litany of private services did not collect the anticipated level of revenues. Think buses to federal attractions that were not operating at normal capacity or even as simple as government attractions that were closed, the huge missing consumption of federal workers paid by the government, etc. As the author mentioned in the last article; the equity market is really a playground for well-heeled investors who can invest, and invest with size. Fixed income, which is what a majority of senior citizens invest with, in retirement, has not made any notable returns. The small-time, retail, investors are becoming more invested “the growing involvement of Main Street investors in the stock market just as we’re hitting all-time highs — a contrarian sign, if there ever was one.” Probably lured back to the market by incredible gains seen this year. Link If volatility does indeed return it would be opportune to buy fixed income, as bonds will certainly increase.Fixed income is a good place to safely be invested and hopefully make gains at the same time, bonds or any tangible asset.This is, of course, if the reduction in stimulus adds volatility. Further, bonds have had an extremely rough year, preventing investors currently in the market,to profit from another asset class (namely, equities) rising. Chairman Bernake first mentioned a reduction in stimulus in May, as you can see the assets under management in fixed-income mutual funds have been consistently negative. Thankfully the unemployment rate drops every month. The unemployment rate below 6.5% should trigger an increase in the fed funds rate. This increase in the rate at which businesses borrow (to perform self-improvement tasks) money may constrict the growth of a stimulus-free equity market. However, in the December, 18th FOMC meeting chairman Bernake stipulated that:, the governmental window, which companies use to bridge short-term expenses, will stay at the current (extremely low) rate or 25 basis points (.25%). Also, the FED will be reducing stimulus by 10 bln/month, which seems like a nice, gradual, slope to remove this program. As mentioned in the previous piece, inflation could rear its head when tapering begins, expected inflation kills aggregate demand in anticipation of a lower real price. Businesses will likely invest more in hopes for growth, since they no longer rely on the FED for capital market buying, so look for increased CAPEX which leads to better or upgraded oil/utilities/telecom etc. which would ultimately increase the domestic infrastructure which would increase global trade. So, keeping the open market committee alive this long, may be harmful for global growth. Just as this was being written, the FED decided to reduce stimulus by $10 billion/month. However, they decided to keep the window from which businesses borrow money of at ¼ percent, the interest rate that SHOULD increase will remain pegged very low. That decision is likely done to increase CAPEX spending, a form of stretching stimulus Finally, money managers are going on an end of year “spending spree.” The removal of stimulus is prodding investors to reaffirm the strength in businesses they thought was/is there. Money managers (a large majority of which have woefully trailed the broad equity market returns) are trying to not repeat the same mistake of being slightly invested at the beginning of the year. The remaining question is: how will the markets react then transition from Benjain Bernake to Janet Yellen. As a FED chairperson.

The author has great confidence in a continuation of a rising equity market, well into next year. Not the pace or of the current rise, but certainly the direction. With all three major indices constantly breaking their all-time highs, and the current rally likely to be supported by a “Santa Claus bump” in demand, this all points to a growing net profit line.Also the increase or hiring should lead to more disposable income, which is a boon for manufacturers. All measures of economic performance are pointing up. Again, the rise this year was extraordinary, do not look for the same percentage increase next year, next year will probably, barring any major crisis, be a more tepid 10-15% year for equities. On December 12, the Census Bureau reported that retail sales rose a healthy .7 percent in November from October, and were up 4.7 percent from November 2012. So far this year, retail sales are up 4.3 percent from 2012. More people are working at slightly higher wages, and so they’ve got more fuel for consumption. Meanwhile, something else seems to have changed. Since the financial crisis, American consumers have been hacking down at their mountain of debt—through foreclosure and default, yes, but also through paying down credit cards, home equity lines, and credit cards, and by stopping themselves from taking on new debt. Generally, the amount of revolving debt (i.e. credit cards) is back to the level it was at in 2006. But this is changing. Earlier this month, the Fed reported that in October, revolving credit rose at a 7.5 percent annual rate. Americans are gingerly releveraging. (Matthew Boesler at Business Insider dubbed a chart showing this increase “the most important chart of 2013.”) That’s good news for consumption, so long as people can maintain their debts. And guess what? Debt service as a percentage of disposable income is at an extremely low level. Economy has been expanding for 53 months, and that payrolls have risen by nearly 7.5 million since February 2010. Link

0 Comments

|

Archives

August 2014

Categories |

RSS Feed

RSS Feed