|

Insider selling (executives selling stock in their own company, a bearish sign) has reached a high. Yet, insider selling of certain, but important industries has NOT reached a high. Those industries are: financials, energy and basic industrials. Ill go through each industry and explain why this may be undue pessimism: Financials: An industry, which relies heavily on trading profits, trading profits come in up OR down markets, however, in down markets profits are limited (cannot derive profits after 0). In up markets profits are unlimited. Energy: If more companies (particularly manufacturing) need to operate more/longer, forcibly those companies will need more energy. This, I believe is an important, indicative, industry. Basic Industrials: It would seem like basic industrials go into production of almost everything. If that industry in going well, like energy, it would seem like production, thus (hopefully) the economy is doing well. Five years into the bull market, Byron Wien doesn't see a top in sight. In fact, the vice chairman of Blackstone Advisory Partners says that there's still plenty of time to buy stocks. I think the market's going to flutter around a little bit here in the first half, but I think it's going to be relatively strong in the second half, and I think this year is going to end up surprising people favorably," Wien said on CNBC. A trader in VIX has, again, bought a huge quantity of VIX call options in hopes that the index rallies (not good)between now and May, (VIX, as I explained in the second piece, increases based on the “noise” around the general movement of an index, in this case the SPX.) VIX has rallied over the past week, based on fears that the market is reaching overbought territory or is in a “bubble,” and the geopolitical events in Ukraine/Russia.Markets do seem a bit “frothy,” however, the author thinks that the only thing that needs to happen, is the fact that thousands of large brick & mortar retailers are closing stores. That action foretells deflation, with no consumers to buy cheapened goods (jobs are being cut) countries might drag the global economy down, starting with the inability to purchase goods here.Goods that other countries produce. Decoupling (when other countries do not need to rely on the US to sustain their growth, it can come from increased domestic production/sales {preferable}, or from an international sales pickup).China and the other BRIC countries are beginning to not rely so heavily on the US for growth. This can be a good thing, or a bad thing, we (the US) suffer by a decreased velocity of trade between the decoupling countries, but it’s a positive because, an increased, worldwide, velocity of money has a positive economic effect for the global economy.

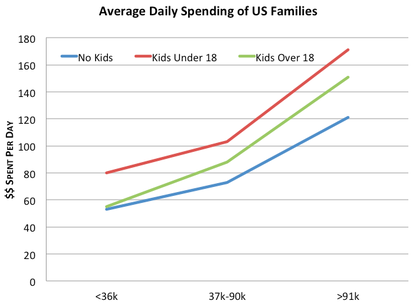

A childless economy is also detrimental to global growth, once guaranteed consumers will slowly dwindle down and harm the growth prospects of OTHER countries. China is driving down exchange rates in an effort to keep their factories pumping out products for US consumers. Clearly, If China continues they will have fewer consumers to sell to. As said in the third piece, all MINT markets boast a young and increasingly educated younger population. Not immediately, in the long term, however, it might be wise to SLOWLY reduce domestic exposure. This is a very slow moving theme, Perhaps the US can increase baby “production” and this demographic disaster can be avoided. Equities do seem like they are trying to find traction before continuing last years rise, albeit at a much muted pace. Economic indicators all point towards growth, and the indicators foretell an eventual boost in spending and thus earnings. Also, companies are almost done working through their over-production (as a result of consumers not consuming at their regular pace), once their inventory reaches normalized levels, US production can ramp up again. In an effort to find directionality,worldwide markets arevery active next month could be very indicative of the direction the global economy is headed. Many major indices, all over the world, are trading at or close to points that, if crossed in the wrong direction could mean a great deal for that countries economy. The future movement in equity prices are definitely no reason to be completely in, or completely out of equities or the markets. The future movement is just a small sample of the entire financial picture.

A much longer, structural change, is that the US GDP has been falling, since its peak in 1969. The author has many beliefs as to why, belief is that the rise of technology (you can now order anything from the internet) has imposed complacency on the population as a whole. Why go to the store if you can get the same product delivered to you door? Thankfully entrepreneurs are hard at work coming up with new ways to try and make foot-traffic fall more slowly. Thankfully is does seem, from looking at holiday shopping bonanzas, that a foot-traffic fall off is a long way off.

0 Comments

Leave a Reply. |

Archives

August 2014

Categories |

RSS Feed

RSS Feed