|

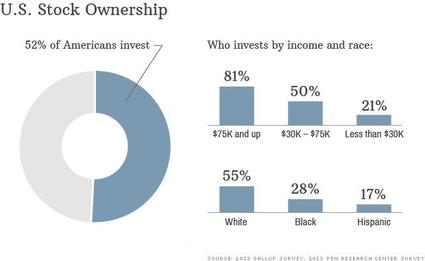

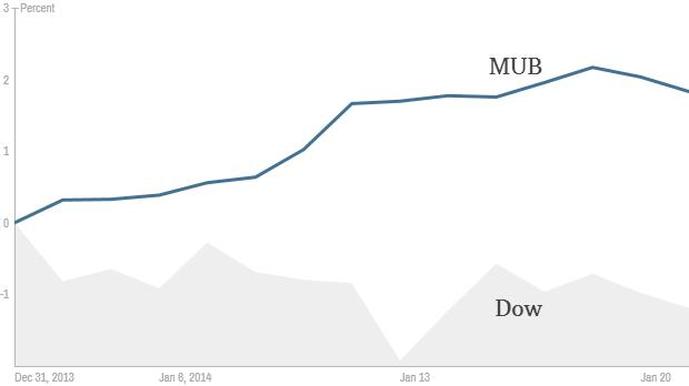

The equity market seems to have lost steam (but hopefully not momentum) with the turn of the year, and especially in the second half of the month. Equities seem to be fair-valued—in this type of market fundamental analysis, AND having a longer time horizon for expected profits are keys to excess returns. With the recent pullback, it should create buying opportunities and will lure investors back into the market. Whereas all of 2013, especially the last quarter of 2012, was a “shooting gallery,” when it seemed like almost any equity you poured money into yielded awesome gains. This year it would be wise to look at historical price charts, and also look if order flow is increasing, which clearly points at higher net income. Earnings momentum, undoubtedly is an advantage to, all this coincides with the suggestion that fundamental analysis should be core to the equity selection process. Earnings momentum ended last year on a very positive note, q1 earnings should confirm reported earnings. A “great rotation” from equities into fixed income could come this year, as said GDP growth follows equity returns and equity returns. Moreover, with the increasing average age of the population, there is a high chance this shift could happen within >10 years. It would be shrewd to look for counties that this shift will happen sooner rather than later.  A pullback after the relentless rise we experienced , unbroken for <12 months), is more than needed, corrections serve two purposes. They help to slowly restore faith in the equity market by: pulling investors who remained on the sidelines after the tremendous run of last year into the market and with more investors participating the swing to positive territory could be much more dramatic. The beginnings of this trend were apparent at the beginning of this year, likely due to the volatile beginning of the year. Also, it gives a chance for investors already in the market to rebalance or adjust weightings without too big of a hit on year-to-date returns. Thankfully this correction happened towards the beginning of the year. Pent-up profit taking was apparent in the beginning of this year; many investors were probably delaying profit taking for tax reasons. Such tax strategies are positive for personal wealth, but deleterious for the market and popular equities (making them more attractive). The volatility of the beginning of the year is also a positive for investors coming off the sidelines, and coming back to investing after having waited 5 years. The demographics of the US are changing, slowly. The average age of a US citizen is closer to 40 than 30. This can be positive for companies that innovate new, useful products, yet can be deleterious to innovation. To supplement my expected innovation drought is the looming education bubble: "The credit-driven higher education bubble of the past several decades has left legions of students deep in debt without improving their job prospects."- Glenn Reynolds Link There needs to be a structural change to the, hidden, education crisis. Perhaps online education is filling that void? The author is incredibly focused on education. Smart kids mean better companies, more innovation, increased consumption, and finally, in the extremely long term, increased equity prices. Also, with the changing demographics the healthcare should have, at least, several tears of hearty growth. Gold is at lows, equity’s are at highs, 10y yields are around 3%, market volatility is becoming more and more pent up, waiting to explode as markets rise ever higher. (Note: this was written in mid-January) Volatility breed’s opportunity, opening up trades that were once crowded, yet the investments, is fundamentally unchanged. International investors are the most upbeat about the global economy than at any time in almost five years, buoyed by the U.S.-led revival of industrial nations, according to the Bloomberg Global Poll. Link Another catalyst to equity markets is that the unemployment rate continues to, steadily, drop. Also, a white-collar wages are set to rise which implies that “unskilled” workers could augment the wealth of their bosses, improve sales and permit investors (traditionally white-collar workers) to, either start investing again, or make; larger purchases in the market. Another catalyst for companies and therefore equities is the INCREASING rate of technological advancements: “Something very, very big happened over the last decade. It is being felt in every job, factory and school. My own shorthand is that the world went from “connected to hyper-connected” and, as a result, average is over, because employers now have so much easier, cheaper access to above-average software, automation and cheap genius from abroad. Brynjolfsson and McAfee, both at M.I.T., offer a more detailed explanation: We are at the start of the Second Machine Age.” Suddenly, the speed and slope of improvement, they argue, gets very fast and steep. Link Interest rates WILL rise, the economy is healing and extremely accommodative rates are unsustainable if the population wants the government to grow, or benefit, from he economic expansion. “The debt overhang has been greatly reduced, monetary policy has, and will, stay incredibly loose, to speed up global circulation of capital.” Some non-investors may indirectly benefit from an up market. For example, a pension recipient may be less likely to face benefit cuts thanks to strong returns by a pension fund. A phenomenal past year in the stock market encourages wealthy consumers to spend more, which stimulates the economy. That is hoping that the jobless rate continues to fall. A surprisingly weak December jobs report suggests the optimism got ahead of itself. The Labor Department reported today that employers added just 74,000 jobs in December from November, less than half economists’ expectations of about 200,000. Link Despite the tepid (but still positive) job numbers in the last month of 2013: what the quote fails to mention is that the job gains made in the 11 other months have a positive effect on the economy, increased consumption, circulation, and confidence. Along with increased hiring, trade domestic, and international has also picked up. Technically we have forfeited our, honest, trade numbers to China, However, although China is clearly in the lead, they still report inflated numbers. Curious. China Customs, everyone agrees, counted a substantial number of fictitious export transactions last year. Even with China reporting their trade numbers in an extremely optimistic manner. Link Although with these factitious trade numbers, the global economy is set to expand in 2014, led by the US and China. It is impossible to time a pullback. The only thing to hope for is that it is not so severe that it takes out new market participants. A mentor of mine said: “this is not a trading market, rather, it is a long time-horizon market.” Which bolsters the point made earlier in the piece, fundamental, rather than top-down analysis is what will drive returns in this market. For this year expect, again, equities to rise, perhaps buoyed by employment, housing and trade. Janet Yellen (the new FED chairwoman) doesn’t need to worry about when to remove stimulus, instead she has the perhaps more daunting task of retightening (increasing interest rates). Potentially even more detrimental than when “tapering” was announced. The markets, and businesses have grown accustomed to borrowing money for virtually no rate. Hoping the economy strengthens enough so that rates may actually rise, and the government actually make income on their loans. This (long term) might be a boon for the broad equity indices.

Expect around 4% growth, a much faster rate than what we’ve grown accustomed to, except last year. There does not seem to be too much (irregular) political noise. All positive factors for this years market. While pent-up buying does not seem too apparent, as that was clearly apparent in 2013, what might be the theme this year is that “retail” investors might come back into the market place. As well as increased investment in once shunned markets. Europe will (and is currently) exit recession, with the peripheral economies benefiting from the strongest relative improvement in growth prospects. Meanwhile, 3% annual GDP growth is no longer out of reach for the United States. And emerging economies will be anchored by China’s slower but still-robust 7% annual growth. Link

0 Comments

Leave a Reply. |

Archives

August 2014

Categories |

RSS Feed

RSS Feed