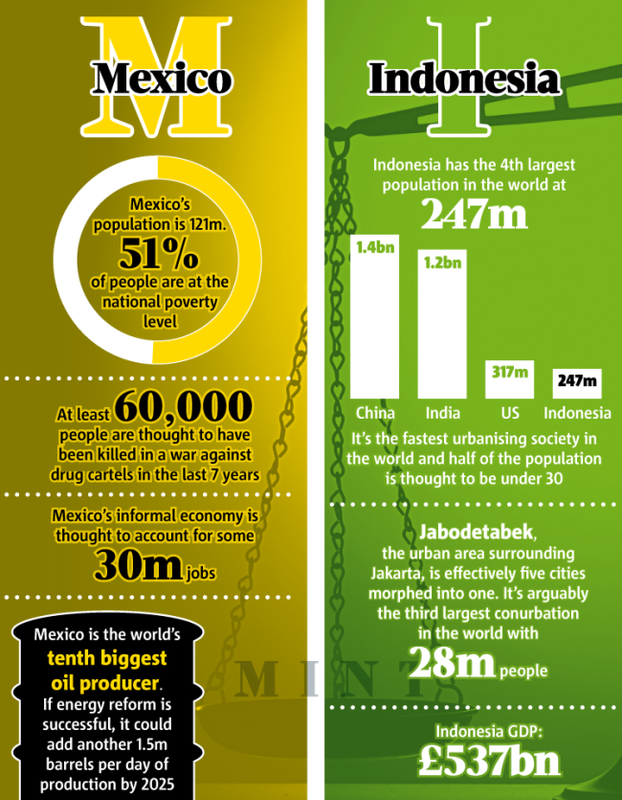

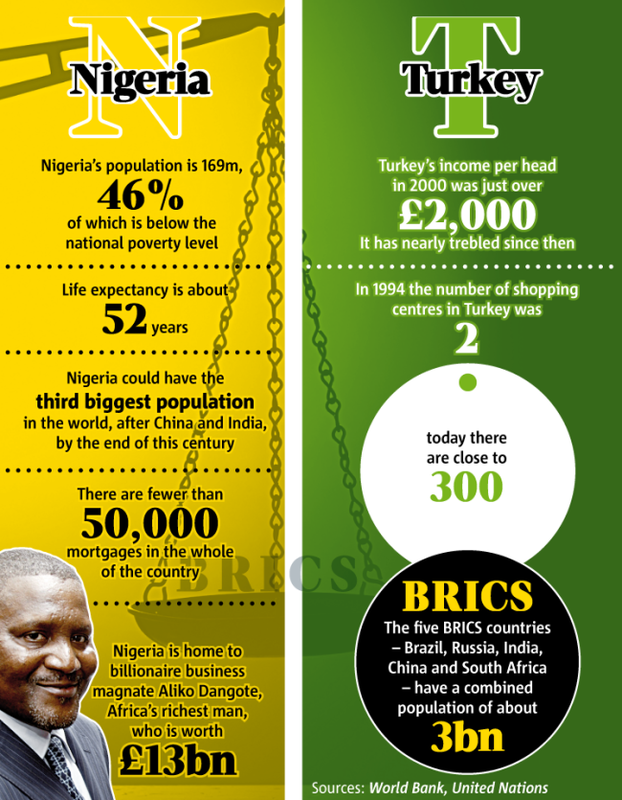

The latest investment acronym fad has arrived, MINT (Mexico, Indonesia, Nigeria, Turkey). These countries do offer attractive investment opportunities, perhaps it would be wise to allocate small portion of your portfolio to this new group. The performance of the MINT group for the beginning of 2014 has been much stronger than the S&P, also the performance should increase since all countries in this group have a clear economic advantage, one, shared, advantage is that each country on the list shares a growing class of young-adults, which should be a windfall for the consumption and all the secondary and tertiary factors that contribute to that: Mexico: For one the average age is below 30. The energy sector of Mexico is a huge benefit to the growth of the county. There is a definite abundance of sunshine in the state and Mexico is steadily increasing its energy output. Another positive attribute, as mentioned before, is the average age, which is below 30 years old. The age might not seem like a huge talking point, but consider how much consumption, especially a citizen in a country between 1) the second largest economy in the world (we forfeited that title to China’s, fishy trade numbers) and 2) the continent of many upcoming mass consumers (South America – home of Brazil). Mexico has boosted exports to the US as well the country has introduced a host of new economic reforms to fully capture the revenues derived off the increased exports. Finally, the location is quite fortuitous. Located between the world’s second largest economy and a major trading partner with Brazil (remember the BRIC acronym?), also Mexico has a solid trade partnership with China, which should be a major benefit as the Chinese population moves towards consumption. Indonesia: The majority of consumes are under the age of 25, unbelievably. The automobile industry, and all the industries that directly benefit, will likely see a large increase in business since Indonesians are commuting less and less on bike and more by car. Nigeria: While the content of Africa has been over looked for investment, it may be time to rethink that investment trait. With the rise of the youth population (again), the disposable income is surely set rise, which benefits a litany of industries. As one of the sole investment countries (Kenya being the other) the likely coming increase of investment will surely benefit the country, by increased investment in economic staples, those companies will likely, increase wages and buy equipment and material from other smaller Nigerian suppliers. All these factors make an extremely attractive investment climate in Nigeria. Turkey: This European country is currently in the process of sorting out its political issues. Turkey, which still uses the Turkish Lira, not the Euro, has faced significant declines in its currency; the declines will most likely be a win for all the exporters of Turkey. Also, the country has the unique fortune of being on two continents (Europe & Asia), which will definitely be a major shipping hub as global trade increases. With Gold prices still falling (but expected to come back into favor in q3/4 of this year), housing already well-into its bull market, and bonds will probably not made any meaningful returns this year, equities will still be a place for investors to park money. Equities already had a stupendous rise in 2013, but the remainder of this year should see an equity rise due to, investors coming off the sidelines, the domino effects of last years rally and the infrastructure spending that Barak Obama has pledged to invest in in his second term.

For this year expect much slower growth (but growth, nonetheless), a continual improvement of the jobs picture, and increased global trade.The broad equity index, the S&P is expected to rise but no more than 10-15%, the wait for fixed income might be another year before we see any meaningful returns, physical commodities. Gold namely, will have to wait another 6 months at most, hopefully.What Bernake needs to realize is that his maintenance of stimulus for so long was keeping citizens invested in fixed income to avoid anticipated inflation. A good place to focus on to avoid the noise domestically would be the aforementioned MINT counties, however those counties host their own domestic issues.

1 Comment

|

Archives

August 2014

Categories |

RSS Feed

RSS Feed