|

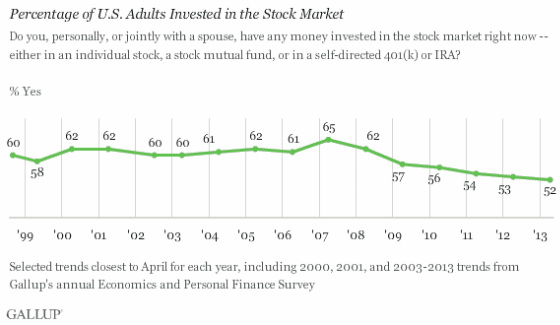

By Nicolas Uppal Equity markets have enjoyed a breathless rise over the past year; the remainder of December should be the same. The data indicate, from previous bull-market-years, that the end of the year usually rises faster than the average rate of gain over the past year, as a whole. This would mean the equity markets(SPX/DJIA/NASDAQ) up 26%, 22%, & 33%, respectively, would increase at a quicker pace in December. The SPX has been increasing on average 2.25% each month. “The broadest equity rally on record will pick up speed through year end and lift the Standard & Poor’s 500 Index to the biggest annual increase in 16 years, if history is any guide.” Source: link The recovery has been excellent for an individual who was well off before the financial crisis; however, the retail investor is keeping money on the sidelines or was wiped out, and is scared to participate now. The completion of the year, with the meteoric rise of the equity markets will perhaps lure the retail investor back into the market, however, with the heat-up of the housing market (which is already falling in some areas) means the country as a whole could be poised for an even deeper and more painful “triple-dip” recession. Thankfully, job growth remains robust. However,perhaps more and more people are no longer eligible to be counted as unemployed. Since the last crisis was related to credit, banks are very stringent about lending money in fear of repeating the same crisis. This, smartly or not, has probably forced consumers to either take out loans with exorbitant interest rates or to use what little savings they have to make rent/pay off their mortgage. There just needs to be a slight trigger, maybe a down week, or one other consumer of American exports to slow the pace of purchasing to cause large investors to stop investing and slow money circulation to a trickle, for the economic slowdown, domestically, to begin. This slowdown could be very perilous for the global economy, as many countries rely on US consumption. It is worrying that many buyers of new homes are private equity, and hedge funds; they are buying up a great deal of foreclosed homes. This has ominous signs of the last crisis we went through. What is worrisome is that the private sector financial institutions COULD: become mass landlords, securitize the income stream of rental payments, pay Moody’s or S&P for a AAA rating on their newly created product, and sell it to the public. This is worrying because as more companies begin to outsource their lower complexity jobs to developing countries we could be set up for another crisis, not unlike the one we just finished.

If there is indeed another pullback it could scare even the most die-hard investors. Perhaps there could be another round of “taper tantrum” that gets over-blown. Chairman Bernanke has said that the government support of buying open-market securities will be ending soon, this is affectionately known as“tapering.” In the beginning of next year inflation could pick back up as a way to reduce the cost that the government actually spends on their purchases. This could be a well-planned move. “Are we worried? Of course,” Reserve Bank of India Governor Raghuram Rajan said at the IMF’s annual meeting in Washington in October.“Everyone is worried about a global storm. A dress rehearsal for what might happen when the Fed pulls back its support occurred in the summer, when even the suggestion that tapering would begin soon sparked a selloff of bonds and currencies from Brazil to India. “There is transition tension,” South Korean Finance Minister Hyun Oh Seok said in an interview with Bloomberg News, also during the IMF gathering. He urged the Fed to move cautiously.” Source: link Retail stocks are up, however, almost 42% that indicates that feverish consumerism has been taking place. This is probably due to pent up demand from the lack of consumption in 2008-20012. This holiday season look for a rather tepid shopping response as consumers, a large majority, have already purchased “big-ticket” items and frankly may be out of liquid assets. It looks like there are trade agreements being worked out between nations, which would surely increase money velocity and would expand the bottom line of the income statements of many exporting companies. All this, in turn, would be a positive windfall for equities but as I mentioned before, we could be on the precipice of a bad bond market. China is finishing their phase of the producer market, and switching to the consumption phase of their growth. The Chinese consumer economy may become larger than US consumer economy in 5 years, very quickly! That is likely the virtue of companies looking to expand their bottom line and the desire of Chinese citizens to “keep up with the Joneses,” which would be the US in this case. If this is the case, look for companies, which already have a strong global presence (Coca-Cola, Nike.). These could be the harbinger of increased growth of domestic companies that, again, have a strong global presence

10 Comments

3/30/2014 02:10:35 pm

I have never heard about this information I have noticed many new facts for me. Thanks a lot for sharing this useful and attractive information and I will be waiting for other interesting posts from you in the nearest future.keep it up.

Reply

9/8/2014 11:13:02 pm

Reply

9/8/2014 11:19:34 pm

Reply

9/8/2014 11:25:35 pm

Reply

2/13/2015 01:55:16 pm

The blog is good and its pleasant for me to read. I have known very important things over here. I admire the valuable advice you make available in your expertly written content.

Reply

2/15/2015 04:05:13 pm

Giving the great efforts about the topic of equity subject.I am found of such type of market updates for equity market.

Reply

11/7/2016 02:09:34 am

I Like that kind a nice Blog. keep's continuous your writing.

Reply

3/24/2021 09:09:21 pm

I Appreciate the way blogger presented information regarding the concerned subject. Keep Updating us... Thanks/

Reply

4/2/2021 09:25:17 pm

Best work you have done, this online website is cool with great facts and looks.

Reply

Leave a Reply. |

ArchivesCategories |

RSS Feed

RSS Feed