|

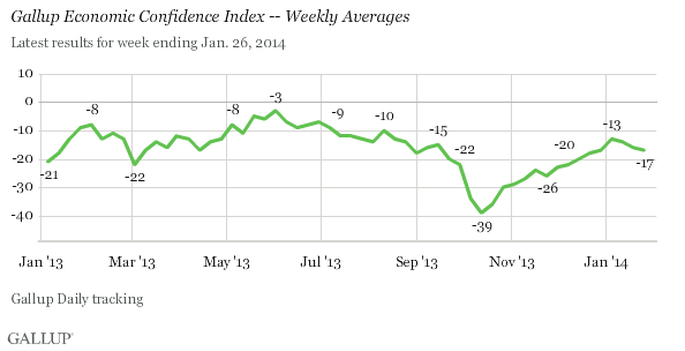

A, needed, pullback is gripping the equity markets. The SPX has lost roughly 3.5% of its value; accordingly, consumer confidence has slipped. “Strong household spending and robust exports kept the U.S. economy on solid ground in the fourth quarter, but stagnant wages could chip away some of the momentum in early 2014." January, is down almost 6% MTD and YTD. There is a known pattern; the year follows the first month of that years returns trend (body follows head, right?). The author thinks that given the positive data flow at the end of 2013, means that there is little chance that the equity markets in 2014 end negative. There is acceleration in employment, which means acceleration in consumption, money velocity etc.… Although it is possible for the year to end poorly (2014), the economy would to need grow at a blistering pace of < 3.2% for any reported number exceed the great growth we had in q3 of 2013. This retracement is linked to emerging market counties, however, the underlying investment thesis has not changed. The countries did not change their trade partners nor did they reduce their rate of consumption. Rather, the currencies have decreased in value, their fundamentals have not changed. This could be a negative indicator, domestically if their currencies stay at this level, a depressed currency means that we, or other countries cannot sell tools they need to grow, thereby hurting our growth and growth of other countries. That could pose a serious problem for the global economy. Generally, global GDP is picking up. The auto industry is leading the way (probably led by China); building orders, construction and airlines (to name a few, but economically important) are seeing an increase in order flow/completed orders. Hoping we are experiencing a brief retracement, led by currencies of emerging markets. Optimistically, the trend will pick back up soon. With positive data coming from most countries, consequentially, order flow should increase among all industries, shipping products to various countries that have ordered them. This, in return should boost global gdp. The IMF last week forecast the emerging markets would grow at 5.1% this year, compared with 4.7% in 2013. China is expected to grow at 7.7% this year — hardly a crisis by anyone’s standards. Even hard-hit Turkey is expected to expand by 4% over the next twelve months. Too optimistic? Not really. The euro-zone has stabilized, at least for the time being, which will help Eastern Europe and Russia and Turkey. The U.S. is growing faster than at any time since the crash, which will help South America. So long as China can stay on course, it will carry on lifting the whole of Asia. Emerging Africa remains one of the fastest-growing regions in the world, and shows few signs of slowing down. -- Growth in emerging markets is accelerating, not slowing down. The recent selloff is blamed on EM countries, however, its completely normal to have an unprovoked sell off after 16 months of extraordinary returns. Link Although their respective currencies have cheapened in the MINTS countries, their YoY GDP growth (year over year) of the South American, southern Africa, and southern Asian countries is impressive. The economy in Mexico, is growing very quickly. What could be a potential problematic point is that the Mexican Peso is highly correlated to South American currencies. This could be a problem for two reasons: 1) the recent retracement is blamed on currencies which is a major concern for growth due to the second reason, 2) without a strong currency they may not be able to properly or effectively develop their oil fields, those are a major key for growth. A large contributor to the Mexican economy is the economy of the US. Everyone knows that the move by the Fed to back off from asset purchases, and eventually to raise interest rates, will have major economic impacts here and abroad. The problem is in predicting what those will be and, especially, the magnitude of the effects. One source of uncertainty is the transition from a Bernanke Fed to a Yellen Fed, but it would be easy to over-estimate the importance of that factor. In reality, there is quite of lot of common ground between the outgoing and incoming Chairs. The more important issues revolve around the fact that we are simply in uncharted territory.

The sturdy increase in demand should put the economy on a stronger growth path this year. However, anemic wage growth could take some edge off consumer spending early in the year. Given everything, the author thinks that this year should be in the black for equities. Going from a +30% year to a negative year, sequentially, is rather daft. As well, consumer spending rose at the fastest pace in 3 years despite the government, coincidentally (tapering) or reducing spending at the same time. The positive data flow is certainly laying the groundwork necessary for 2014 to be a positive year, again, not as great a rise as 2013 but still belying the impression that January has given the market.

0 Comments

Leave a Reply. |

Archives

August 2014

Categories |

RSS Feed

RSS Feed