|

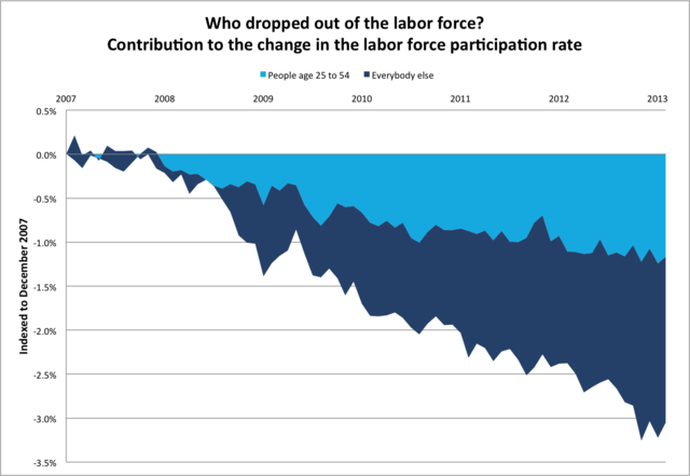

The markets (SPX, DJIA, NASDAQ) is experiencing yet another pullback. Sadly this pullback is most likely clobbering investors that have only recently come off the sidelines. That is two (retracements) this year! With the lack of news flow (no news is good news) and, the increase of people joining the workforce, as well as the increase of hiring, all points to a gradual pick up. The equity markets have increased AHEAD of positive economic news. The unemployment rate might be falling, NOT because of increased hiring, but rather people dropping out of the workforce, the so-‐called “stealth” unemployed. Hiring IS taking place, just not at as vigorous levels as the data would indicate. To deal with this the FED is, clearly, backing away from its previously set 6.5% unemployment mandate, the mandate was set to begin raising borrowing rates. Keeping the federal funds window open at such low borrowing levels could be inflating another bubble. “We know we’re not close to full employment, not close to an employment level consistent with our mandate, and unless inflation were a significant concern, we wouldn’t dream of raising the federal funds rate target,” Chair Janet Yellen said. Hopefully providing the traction that equities are looking for, before continuing last years (slower) rise. “The economy is getting better, and it’s likely the softer patch we’re seeing is weather related,” Josh Feinman, the New York-‐based global chief economist for Deutsche Asset & Wealth Management and a former Fed senior economist, To enhance these gains, is that the US equity markets have undergone a massive price increase, OUTpacing economic improvements. This has definitely been augmented by the US federal reserves willingness to move goalposts (set for borrowing-‐rate hikes) of unemployment, down from 6.5% (to a level we still do not know. The unemployment rate MAY spike up soon due to “long-‐term” unemployed coming back into the labor force (thus destroying the chance of rate hikes, AND extending the rally). “The Federal Reserve gave itself room to keep borrowing costs low at least until next year by dropping a linkage between the benchmark interest rate and a specific level of unemployment” “...and unless inflation were a significant concern... In deciding how long to keep rates low, the committee will look at a“wide range of information,” including labor market conditions, inflation expectations and financial markets, she said. The Fed also reduced the monthly pace of bond purchases by $10 billion, to $55 billion....” Thankfully, deficits on the federal and state level are shrinking. Also, the US is on the road to energy independence (no more wars over oil {essentially}, this MIGHT be injurious for defense and military contractors). Ideally, those sectors would shrink, so such a large portion of the national budget is freed-‐up. Having a larger portion of the national budget available would surely boost GDP, through economic-‐advancing projects such as: infrastructure, poverty spending, increasing of min. wage (increasing consumption) etc. The US economy will most likely not be able to return to > 3% GDP growth rates. The confluence of hiring NOT taking off and the shift from production to consumption in China make for a bleak outlook. Hopefully, confirming the old adage, or theory, that transportation stocks usually predicate a run-‐up in equity prices, the transportation index has rallied and closed on Monday at an all time high. Defying the pullback most equity markets are facing. Valuations are high, however, they are nowhere near their absolute peak, right before the bursting of the 1999/2000 bubble. The Obama administration has set forth with a plan to buy 1 trillion of “troubled”assets from banks. This, risky, move by the US government should help to unfreeze credit markets. This will help by allowing banks to have a quota of “risky” loans emptied, which should definitely help the flow of capital. Since he credit markets are near frozen for citizen Another positive measure directly benefitting the middle class; job gains have been made across the spectrum of industry and job-‐level. This should enhance the earnings of the company they work for and therefore increase the performance bonuses of their managers. Managers usually are invested rather than entry-‐level employees. However, hourly wages fell in March, this COULD mean that hourly employees are being promoted to full time, more likely is that hourly-‐level employees are being let go. With a 192,000 decrease in unemployment, the rate is dropping, slowly. This data indicate that the US economy will return to full employment (not 0 unemployed, rather, unemployment rate at <6.4%). The US economy may take much longer to reach full employment since, the job market grows by ~3% every year and, the US economy suffered 3 years of no growth whatsoever, so that mean the economy has a good deal to make up before it begins to reach “full” employment.

Theoretically, ”full” employment is just below 5%, compounding this challenging measure to reach is that; the population is ALWAYS changing, albeit not by much and the changes are certainly not made by increases or decreases in working-‐age citizens. Rather population growth (also slowing) is a key measure to watch. Jobs, as it must be apparent now, are perhaps the key to economic growth. With in increased jobs the US enjoys a litany of other windfalls. Increased consumption, leading to more jobs. It’s really a self-‐fulfilling cycle.

0 Comments

Leave a Reply. |

Archives

August 2014

Categories |

RSS Feed

RSS Feed